In the field of economics, “hot money” refers to the transfer of wealth or assets from one country to another with the intention of making a quick profit from interest rate discrepancies or potential changes in exchange rates. These speculative capital movements are known as “hot money” because they have a tendency to enter and exit markets quickly, which could result in market volatility.

Hot money is currency that travels swiftly and often between financial market, ensuring that investors lock in the greatest short-term interest rates that are currently being offered. Hot capital flows is always moving from nations with low rates of interest to countries with greater interest rates.

The exchange rate is impacted by these money transfers, which may also have an effect on a nation’s balance of payments. The term hot money can also apply to “stolen money” that has been uniquely marked in order to be traced and identified in the context of law enforcement and regulatory requirements for banks.

What is hot money?

Hot money typically comes from capital-rich industrialized nations with interest rates that are lower than those of emerging market economies like India, Brazil, China, Turkey, Malaysia, etc., who are growing their GDPs at rates that are higher than those of hot money sources like these. The following could typically be regarded as the sources of hot money flow, even though the precise causes vary somewhat from time to time:

Hot money can refer to both capital invested in rival companies as well as distinct national currencies. By providing short-term certificates of deposit (CDs) having interest rates above average, banks hope to attract hot capital. Investors are likely to transfer hot money savings to the bank with the better deal if the bank reduces its interest rates or if a competing financial institution provides higher rates.

Hot money refers in a global setting can only circulate between economies after trade barriers are eliminated and advanced financial infrastructures are put in place. In this environment, money is invested in high-growth sectors that have the potential to generate large returns. Hot money, on the other hand, leaves economically struggling nations and sectors.

How does hot money flows?

Hot money flows are short-term, swift capital transfers that occur within and between nations in reaction to shifting financial and economic situations.

Hot money flows, which are frequently impacted by investment possibilities and market expectations, can also be affected by variables including rate of interest disparities, currency exchange rates, and levels of stability in the economy and politics.

The economy of a nation can be impacted by hot money flows in ways that are both beneficial and detrimental. On the bright side, hot money flows can give nations access to funds for investment and growth and can support the stabilization of financial market during turbulent times. Hot money flows can result in volatile currency rates, high rates of inflation, and financial instability, which is a drawback.

Many governments have put in place capital controls or additional measures to manage the flow of short-term investments into and out of their respective economies in reaction to the possible negative effects of hot money flows. These steps aim to prevent swift and unstable adjustments to rates of exchange and other economic variables while fostering stability and expansion of the domestic economy.

Brazil, South Korea, and Taiwan are a few examples of nations that have put in place capital restrictions to control hot money flows. These nations have taken measures to control the inflow and outflow of short-term money from their economies in an effort to stable their currencies, lower the likelihood of financial unsteadiness, and foster a trajectory of sustained development and growth.

What is the top five hot money investors countries

With 84.1% of FPI inflows, the top five investor nations were the United States, United Kingdom, Norway, Singapore, and Luxembourg.

The vast majority of assets (57.3%) went to securities listed on the Philippine Stock Exchange of banks, holding companies, real estate, foodstuffs, and transport providers. Government securities in pesos were used to hot money investing the remaining funds. Lower hot money inflows may have been caused by a risk-off mindset in the midst of ongoing financial issues and worries about a recession in the US, according to China financial Corp.

Investors’ capital may have shifted from the Philippines to the US as a result of market anticipation of another rate increase from the US Federal Reserve. Gross hot money outflows, meanwhile, increased by 29.3% to $1.06 billion in April from $823.32 million in the same month last year.

According to the BSP, the United States received 70.9% of all remittances sent abroad. The BSP-registered FPIs have generated net outflows of $680.07 million so far this year, in contrast to net inflows of $1.39 billion during the same period in 2022.

Inflows will occur when investor sentiment improves, and this may be the case given that inflation may be on the decline while the BSP has indicated a pause. Inflation may return to the target range of 2-4% by September or October, according to BSP Governor Felipe M. Medalla, assuming there are no supply disruptions.

The central bank (BSP) opted to take a smart break from its tightening cycle as inflation declined and the economy continued to thrive by holding the benchmark interest rate unchanged at a 16-year high of 6.25 percent.

After experiencing a net outflow of $2.4 billion due to the COVID-19 epidemic in 2021, the Philippines had a net inflow of hot money totaling $1 billion last year. The BSP further reduced its hot money inflow prediction for this year from $5 billion to $2.5 billion, but this is expected to increase to $3.5 billion in 2024.

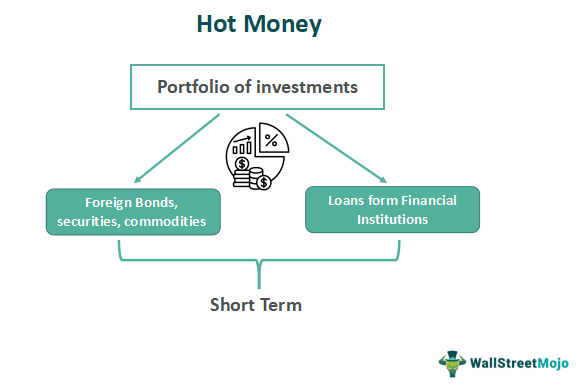

What are the types of hot money?

- short-term international portfolio investments, such as those in stocks, bonds, and financial derivatives.

- Short-term borrowing from foreign banks.

- short-term investment horizon loans from foreign banks.

What is financial markets?

Financial market, which include the stocks market, bond market, currency market, and derivative market, among others, are any marketplace where trading in securities takes place. For capitalist economies to run smoothly, financial markets are essential.

Any location where securities are traded is referred to as a financial market. The foreign exchange reserves, money, stocks, and bond markets are only a few examples of the many different types of financial market.

These markets could feature commodities or securities that trade over-the-counter (OTC) or are listed on regulated exchanges. A capitalist society’s efficient functioning depends on the efficient operation of financial market, which trade in all varieties of securities. Economic upheaval, such as a recession and unemployment, can happen when financial market fail.

Is Investing In Hot Money a Good Idea?

The hot money inflows investing method is not suitable for those who lack courage. This tactic involves luck, financial acumen, and market awareness. However, investors can heed the following guidance to improve their chances of profiting from hot money:

- Conduct analysis

Prior to beginning an investment, it is generally advisable to obtain as much data as you can. It is frequently believed that the distinction between a savvy trader and a careless investor is high-quality information.

- Start Little:

It is preferable to begin modestly when implementing a new investment plan. It aids in reducing the possibility of first, significant losses. Once one has mastered a particular skill, they can always aim higher.

Wrapping up

This has served as a guide to the types, investors, and meaning of hot money. After reading this article, why not consider making investments in real estate?

One of the greatest real estate developers in the country, BRIA Homes, intends to offer more reasonably priced house and lot packages to typical Filipino families. BRIA Homes enjoys its quick expansion very much. If you are interested to learn more, go to our website. You can get virtual tours anytime it’s most convenient for you on the Bria website. On their own web page and social media platform, the Bria community’s genuine grandeur can be viewed via a desktop or mobile device.

Author: Mat Balbin